Hydrogen insurance

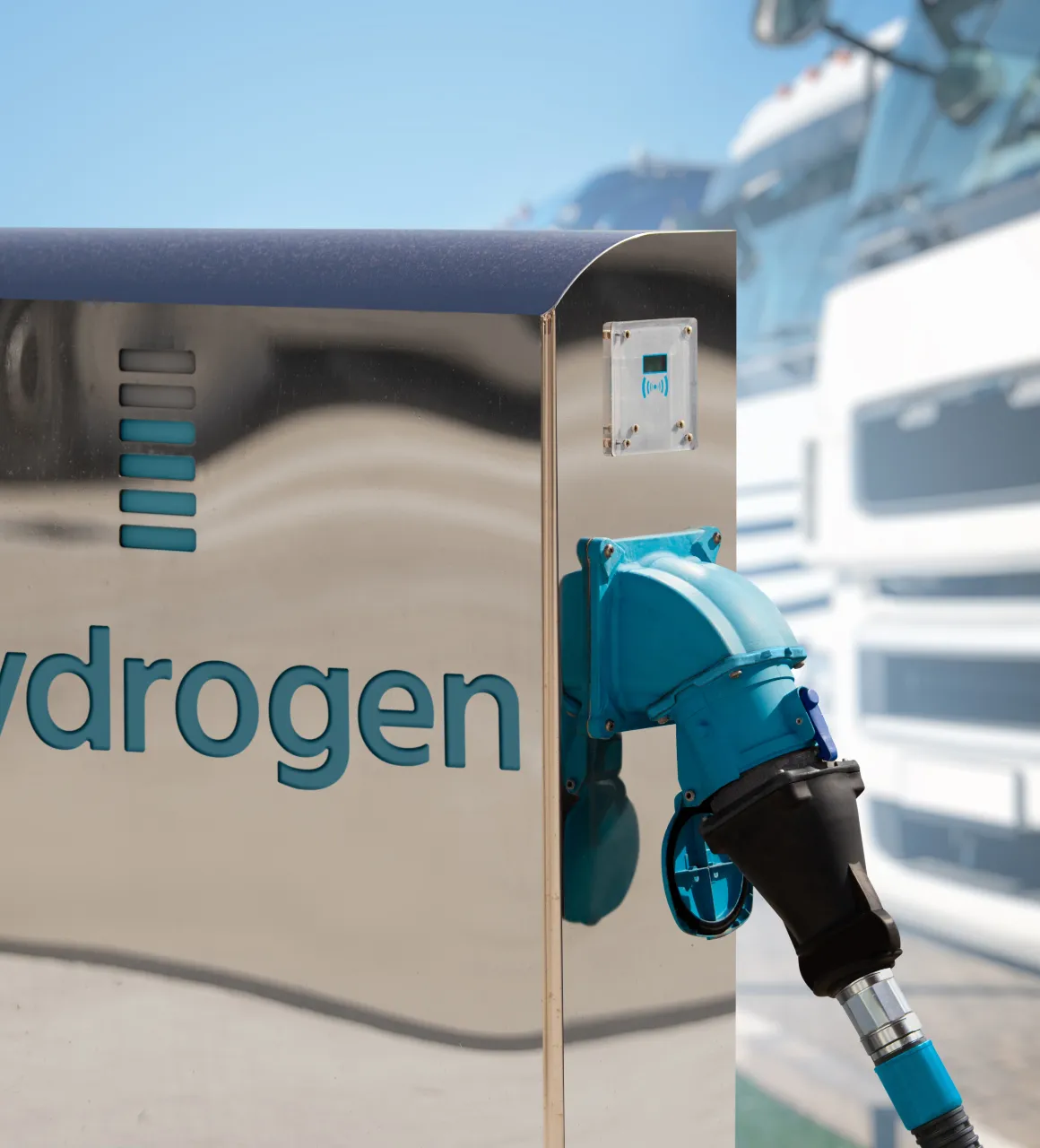

As specialists in renewable energy insurance, we bring our expertise to hydrogen professionals, particularly in the field of green hydrogen.

A solution combined with an asset for producing renewable source energy such as wind energy, photovoltaic energy, etc., which makes it more complex to insure.

Our understanding of your risks means we can offer you a policy on the best possible terms.

A technical audit of your hydrogen project to define the right policy

Our expertise in hydrogen means we can help you secure and optimise your project from the outset.

The essential criteria that can influence your insurance policy are: technical design choices, analysis of surrounding risks (including nearby recharging vehicles), and fire risk prevention.

To identify the right criteria, we carry out an audit using a specific methodology, and always draw up bespoke policies.

Your technical choices studied by our Alexis Assurances teams

We’ll work with you to analyse the choices you’ve made in designing your hydrogen facility, and study the most appropriate policy based on:

- the type of membrane used;

- the replacement of critical elements;

- the maintenance of power supply security systems.

The two main risks to be insured with hydrogen

When it comes to hydrogen, two points are essential and are analysed very closely by insurance companies. Firstly, fire and explosion prevention, which is a matter of course in terms of insurance. But also calibration of the revenue to be insured.

On this last point, the hydrogen (H2) production station itself consumes electricity, so we need to work together upstream to identify the gross margin generated.

How do you insure a hydrogen production system? Our solutions

We provide H2 manufacturers and producers with a range of solutions:

- Construction All Risks insurance,

- Multi-risk business insurance.

- Production Civil Liability

- Builder Civil Liability